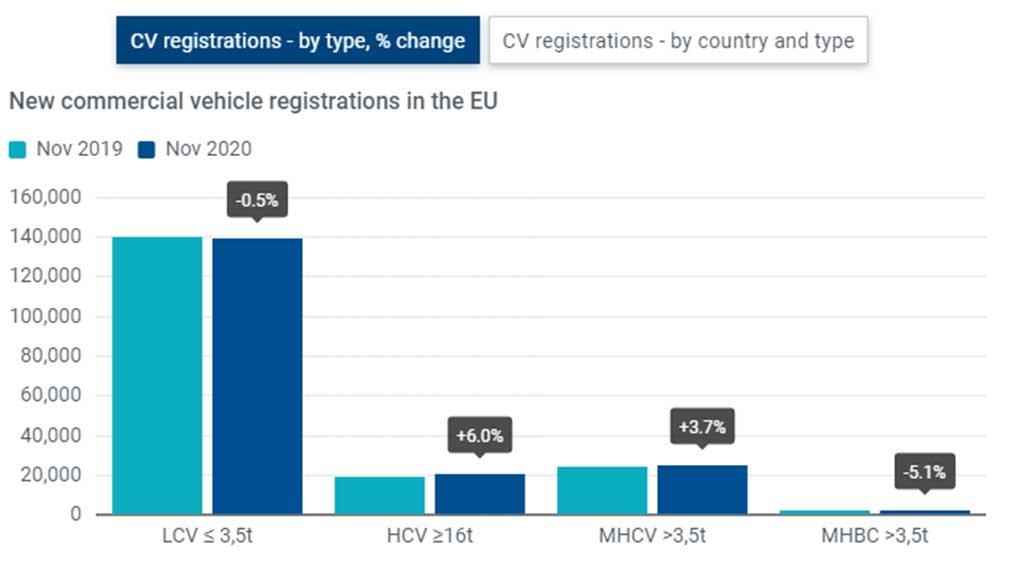

Commercial vehicle registrations: -20.3% 11 months into 2020; +0.1% in November

In November 2020, the EU market for commercial vehicles posted a very modest increase, with new registrations up 0.1% to 167,315 units.

Demand for vans and buses slowed down last month, while the truck segment contributed positively to the region’s result. The four biggest markets posted a mixed performance in November, with registrations contracting in Spain (-7.0%) and France (-3.1%), while Italian (+11.7%) and German (+4.3%) markets expanded.

At 1.5 million units eleven months into the year, commercial vehicle registrations in the European Union are now down by 20.3%. All EU27 markets – including the four major ones – have recorded double-digit declines so far in 2020, although less steep than in the preceding months: Spain (-28.4%), France (-18.4%), Germany (-16.3%) and Italy (-15.6%).

New light commercial vehicles (LCV) up to 3.5t

In November, demand for new light commercial vehicles in the EU remained stable (-0.5%) compared to one year ago. Results in the EU’s top four markets were mixed: registrations in Italy and Germany were positive, growing by 10.3% and 6.2% respectively, while LCV demand contracted in Spain (-8.1%) and France (-3.8%).

From January to November 2020, new van registrations declined by 18.7% across the European Union, now standing at 1.3 million units. Spain recorded the sharpest drop (-28.8%) so far this year, while losses were less strong in France (-17.6%), Italy (-15.4%) and Germany (-13.4%).

New heavy commercial vehicles (HCV) of 16t and over

Last month, the EU market for heavy trucks improved, with new registrations up by 6.0% to 20,620 units. Central European countries (+28.6%) largely contributed to this result. Among the largest Western European markets however, only Italy (+28.5%) managed to post growth.

So far in 2020, 181,590 new heavy commercial vehicles were registered across the European Union, a decline of 29.6% compared to 2019. Despite last month’s positive performance, each of the 27 EU markets recorded double-digit drops so far this year, including Germany (-28.6%), France (-27.9%), Spain (-23.9%) and Italy (-14.2%).

New medium and heavy commercial vehicles (MHCV) over 3.5t

In November 2020, demand for new medium and heavy trucks posted a modest upturn (+3.7%), benefiting from the positive performance of the heavy-duty segment (which makes up the bulk of total truck demand). As for the biggest EU markets, Italy recorded the strongest gain (+21.7%), followed by France (+1.3%) which posted a more modest growth. By contrast, MHCV registrations slid 3.0% in Germany and 1.0% in Spain.

Eleven months into the year, registrations of new trucks declined sharply across the European Union including in the four major markets: France (-26.2%), Germany (-26.1%), Spain (-23.3%) and Italy (-15.1%). This contributed to a cumulative retreat of 27.7% to a total of 226,427 trucks registered so far in 2020.

New medium and heavy buses & coaches (MHBC) over 3.5t

In November 2020, new bus and coach registrations in the EU slid back by 5.1% compared to November last year. Although all major Western European markets – Italy (+27.0%), France (+13.4%), Germany (+11.6%) and Spain (+5.8%) – posted positive results, Central European countries (-22.6%) dragged down the overall performance of the region.

From January to November 2020, EU demand for buses and coaches contracted by 23.5%, counting 25,532 new registrations in total. Among the largest EU markets, Spain (-41.3%) and Italy (-27.3%) continued to struggle 11 months into the year, while losses were more limited in France (-9.5%) and Germany (-2.4%).

Source: acea.be